top of page

Insights

At Avail Investment Partners, we provide timely insights to help you navigate the complexities of the global financial landscape.

Our commentaries cover key topics such as macroeconomics, market performance, geopolitical events, and thematic investment ideas, offering actionable perspectives on the factors shaping today’s markets.

Our team of seasoned professionals analyzes the latest trends and developments to deliver the knowledge you need to make informed investment decisions with confidence.

Explore our latest insights below and stay ahead in an ever-changing financial world.

Subscribe to our email list to receive our whitepaper:

5 Essential Strategies You Should Be Implementing as a Business Owner

.png)

The Sunday Drive

The "Chart Of The Week" section from Mike Allison's newsletter, The Sunday Drive.

Chart Of The Week 1/25/2025: A “Normal” Japan and the Unwinding of the Carry Trade

📈 Chart of the Week 1/25/202 6 By Michael Allison, CFA A “Normal” Japan and the Unwinding of the Carry Trade This week’s Chart shows that following the global inflation scare of 2021-22, long term interest rates in Japan have continued to rise, but unlike in other countries, at an accelerating pace. Some say this is due to Japan’s reemergence as a “normal” economy which is being framed as a curiosity: an end to deflation, a long-overdue policy shift, a local story. That

Michael Allison, CFA

Jan 25

Chart Of The Week 1/18/2025: Performance, Construction and Diversification

📈 Chart of the Week 1/18/202 6 By Michael Allison, CFA Performance, Construction and Diversification You’ve probably seen headlines crowning NVIDIA as the unstoppable force powering the stock market in 2025. It was the largest contributor to the S&P 500 Index’s total return last year, a title it earned not by being the best performer, but by performing reasonably well and being the biggest company in the index . That’s the message of the first Chart this week. Here’s

Michael Allison, CFA

Jan 18

Chart Of The Week 1/11/2025: Thoughts on Productivity-Led Economic Growth

📈 Chart of the Week 1/11/202 6 By Michael Allison, CFA Thoughts on Productivity-Led Economic Growth This week’s Chart shows a marked upturn in productivity in the first half of this decade as compared to the last. While still below the levels of the mid-1990s to mid-2000s during the height of the internet-driven “New Economy” , I believe that productivity is poised to go even higher from current levels, perhaps reaching or exceeding prior levels. Many would agree that we

Michael Allison, CFA

Jan 11

🔮 Fearless Forecasts for 2026

🔮 Fearless Forecasts for 2026 By Michael Allison, CFA Once again, we lay out our outlook for the coming year as a collection of fearless forecasts. But first, in the spirit of “often wrong, but never in doubt” , let’s see how we did in 2025. 2025 Report Card ( link to 2025 Forecasts): U.S. Equity Returns Moderate: We see a moderation of U.S. equity market returns, in particular the S&P 500 compared to 2023 and 2024. Result: The S&P 500 did moderate over 2023 and 2024, but

Michael Allison, CFA

Jan 6

Chart Of The Week 1/4/2025: Big Things Happen When a Word Changes Its Class

📈 Chart of the Week 1/4/202 6 By Michael Allison, CFA Big Things Happen When a Word Changes Its Class Googol: the number represented by 1 followed by 100 zeros. While doing a search for available domain names, the founders of Google originally misspelled the name of their new company. They found the incorrect spelling to be more visually appealing and the name Google stuck. What they built changed the internet and the advertising business forever… and changed the word “g

Michael Allison, CFA

Jan 4

Chart Of The Week 12/28/2025: Valuation of Hyperscalers

📈 Chart of the Week 12/28/2025 By Michael Allison, CFA Valuation of Hyperscalers The Chart of the Week shows, at least according to Carlyle, that the big AI spenders have returned to a sustained level of relative overvaluation - meaning that their P/Es are well above those of the rest of the S&P 500. In my opinion, in the near to intermediate term, there’s more risk to their earnings multiples than their earnings. As these companies are transitioning from asset light to

Michael Allison, CFA

Dec 29, 2025

Chart Of The Week 12/21/2025: Recession Fears in 2025 - From Panic to Perspective

📈 Chart of the Week 12/21/2025 By Michael Allison, CFA Recession Fears in 2025: From Panic to Perspective If you wanted a real-time case study in how markets process uncertainty, overreact, recalibrate, and eventually move on, 2025 has certainly delivered. This week’s Chart tracks the implied probability of a U.S. recession during 2025, derived from prediction-market pricing. It’s an unfiltered window into investor psychology, one that tells us as much about narrative ri

Michael Allison, CFA

Dec 21, 2025

Chart Of The Week 12/14/2025: A Few Thoughts on Volatility Part 2

📈 Chart of the Week 12/14/2025 By Michael Allison, CFA Source: Tier1 Alpha A Few Thoughts on Volatility: Part 2 Last week , we focused the Chart of the Week discussion on volatility regimes and the potential benefit of paying attention to trends in volatility rather than on the level of volatility. Volatility Regimes With this week’s Chart, we also look at trends in volatility, only this time through the lens of a “risk on / risk off” investing environment. A “risk on”

Michael Allison, CFA

Dec 14, 2025

Chart Of The Week 12/7/2025: A Few Thoughts on Volatility

📈 Chart of the Week 12/7/2025 By Michael Allison, CFA A Few Thoughts on Volatility The equity and bond markets have been eerily quiet of late, and it has gotten me thinking about volatility, or lack thereof, and what may lie ahead in 2026. Every market environment carries a rhythm. Sometimes it’s steady and predictable; other times it’s chaotic and dissonant. But if you step back far enough, volatility has a way of revealing what’s happening beneath the surface, not by i

Michael Allison, CFA

Dec 7, 2025

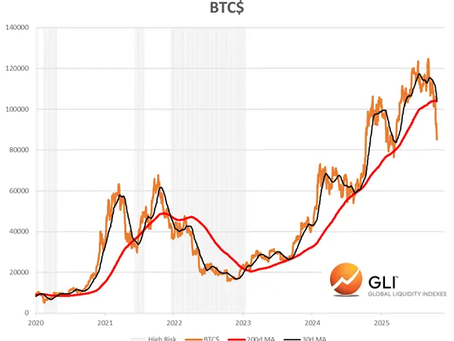

Chart Of The Week 11/30/2025: Whither Bitcoin?

📈 Chart of the Week 11/30/2025 By Michael Allison, CFA Whither Bitcoin? This week’s Chart shows the price of Bitcoin, which has been quite weak of late. We often get questions from advisors about crypto and their appropriate role in client portfolios. A lot of the discussion tends to be framed as a risk and return question. While Bitcoin and other cryptocurrencies are indeed quite volatile, this recent move seems, at least to me, to be a bit more than just “risk off” . A

Michael Allison, CFA

Nov 30, 2025

Chart Of The Week 11/23/2025: You Are Here 🎯

📈 Chart of the Week 11/23/2025 By Michael Allison, CFA You Are Here 🎯 This week’s Chart shows the Nasdaq 100 Index plotted against a number of historical bubbles. When investment bubbles are discussed, it’s common for folks to ask, “Where are we in the cycle?” I find historical comparisons interesting, but not necessarily helpful. I think that the end of an investment cycle approaches as financial stress begins to show in the results of the players in the ecosystem, and

Michael Allison, CFA

Nov 23, 2025

Chart Of The Week 11/16/2025: The Next Productivity Boom Is Upon Us

📈 Chart of the Week 11/16/2025 By Michael Allison, CFA The Next Productivity Boom Is Upon Us We’re seeing quite a lot of hand-wringing lately by investors concerned about equity valuations and the pace and sustainability of capital spending by the AI Hyperscalers. However, this week’s Chart highlights the silver lining of the AI spending boom which will likely benefit the economy more broadly over the coming years, perhaps by quite a lot. I thought it was worth talking a

Michael Allison, CFA

Nov 16, 2025

Chart Of The Week 11/2/2025: Don't Be Early

📈 Chart of the Week 11/2/2025 By Michael Allison, CFA Source: Bespoke Investment Group Don’t Be Early One of the most important and timely questions that investors must ask themselves today is “Where are we?” in the current technological transformation we call Artificial Intelligence. Critically thinking about the answer and getting it right, or at least somewhat right, can create enormous wealth. Or...and this might be even more important these days, prevent its destruc

Michael Allison, CFA

Nov 1, 2025

Chart Of The Week 10/26/2025: Seasonality... Am I Right?

📈 Chart of the Week 10/26/2025 By Michael Allison, CFA Seasonality…. Am I right? The Chart of the Week shows that 3rd quarter performance for the S&P 500 is historically by far the weakest quarter of the year. Q4 performance by contrast is historically the strongest period, and by a significant margin. After a solid year-to-date showing in the first half of the year, with the S&P 500 up 6.2%, most experienced investors and prognosticators had what many could reasonably c

Michael Allison, CFA

Oct 25, 2025

Chart Of The Week 10/19/2025: Crypto in a Golden Year

📈 Chart of the Week 10/19/2025 By Michael Allison, CFA Following on last week’s Debasement Trade discussion, this week’s Chart shows the year-to-date performance of gold, Bitcoin, and Ethereum. It shows quite a divergence thus far in 2025. Gold’s relatively smooth and steady climb has stood in sharp contrast to the choppy and volatile trading patterns of the two leading cryptocurrencies. Many regard cryptocurrencies, Bitcoin in particular, as “digital gold”—a decentrali

Michael Allison, CFA

Oct 18, 2025

Chart Of The Week 10/12/2025: The Debasement Trade

📈 Chart of the Week 10/12/2025 By Michael Allison, CFA Source: www.exponentialview.co/p/is-ai-a-bubble The Chart of the Week captures one of the defining investment narratives of the post-2020 era: the so-called “Debasement Trade.” In simple terms, the purchasing power of the U.S. dollar has steadily eroded while asset prices—stocks, homes, gold, and inflation-linked measures—have soared. Since January 2020, gold has risen roughly 148%, the S&P 500 is up over 106%, and

Michael Allison, CFA

Oct 11, 2025

Chart Of The Week 10/5/2025: The AI Investment Boom: Gauges for Investors

📈 Chart of the Week 10/5/2025 By Michael Allison, CFA Source: www.exponentialview.co/p/is-ai-a-bubble The AI Investment Boom: Gauges...

Michael Allison, CFA

Oct 4, 2025

Chart Of The Week 9/28/2025: Calm Seas Make for Poor Sailors

📈 Chart of the Week 9/28/2025 By Michael Allison, CFA Calm Seas Make for Poor Sailors Since the 20% drawdown this past spring,...

Michael Allison, CFA

Sep 27, 2025

Chart Of The Week 9/21/2025: AI Adoption - Don't Panic Just Yet

📈 Chart of the Week 9/22/2025 By Michael Allison, CFA AI Adoption: Don't Panic Just Yet I found this week’s Chart especially...

Michael Allison, CFA

Sep 20, 2025

Chart Of The Week 9/14/2025: The Oracle of Austin

📈 Chart of the Week 9/14/2025 By Michael Allison, CFA The Oracle of Austin This week’s Chart helps build on last week’s musings...

Michael Allison, CFA

Sep 13, 2025

bottom of page

.png)