- Avail Investment Partners

- May 23, 2025

- 2 min read

Updated: May 27, 2025

Choosing the Right Path: Four Ways to Transition

Your choice of successor will define the future of your company. Here are four primary paths, each with distinct advantages and considerations:

1. Transfer to Insiders

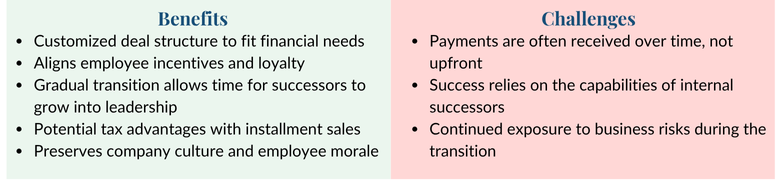

If you have trusted partners or long-term employees, an insider transfer may offer the smoothest transition.

Ideal for: Owners who prioritize culture, employee retention, and phased exits.

2. Transfer to Children: Family Succession

Passing the business to the next generation is a powerful way to keep your values and family identity alive—if done thoughtfully.

Ideal for: Owners with capable, willing children who share their passion for the business.

3. Sale to a Third Party

An external sale, whether to a strategic buyer or a private equity firm, can provide liquidity and a clean exit.

Ideal for: Owners who prioritize financial outcome and swift transitions.

4. Sale to an Employee Stock Ownership Plan (ESOP)

An ESOP allows employees to buy the company through a trust, rewarding them for their loyalty and sustaining company culture.

Ideal for: Owners who want to reward employees, retain the company's identity, and achieve tax-efficient liquidity.

Structuring a Legacy-Focused Transition

Once the right path is chosen, execution is key. A successful transition follows these strategic steps:

Financial Security While Staying True to Your Values

An effective exit strategy also secures your financial future while honoring your principles. Key strategies include:

Tax-Efficient Exit Planning

Installment sales, 1031 exchanges, or 1042 rollovers to defer or reduce capital gains

Charitable giving strategies like CRTs and donor-advised funds

Qualified Small Business Stock (QSBS) exclusions where applicable

Asset Protection & Estate Planning

Trust structures to minimize estate taxes

Buy-sell agreements for insider transitions

Liability protections to safeguard personal wealth

Diversification Post-Sale

Building diversified investment portfolios

Real estate investments, private equity, and passive income strategies

Structured settlements or annuities for reliable income

Philanthropy and Impact Giving

Establish family foundations or endowments

Support scholarships, community projects, or nonprofits

Utilize donor-advised funds for flexible charitable giving

The Emotional Payoff: A Life Beyond Your Business

Imagine five years from today. Your business is still thriving under strong leadership. Your employees are secure. Your company name continues to carry weight and pride in the community.

Meanwhile, you are financially independent, spending time with family, traveling, giving back to causes you believe in.

That’s the true reward of a well-structured, legacy-focused exit.

Conclusion

Selling your business is a profound milestone. When approached thoughtfully, it’s an opportunity to secure your future, reward your employees, sustain your company’s impact—and leave a legacy that lasts.

Planning ahead is crucial. With the right strategies, you can transition your business on your terms and preserve everything you’ve worked so hard to build.

Important Disclosures

Avail and its affiliates do not provide tax or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax or accounting advice. You should consult your own tax and accounting advisors before engaging in any transaction.

.png)

.png)